Prekindle offers flexible options for handling sales tax, depending on your organization’s needs, location, and tax status.

Sales Tax Options on Prekindle

During account setup, you’ll select one of the following sales tax options:

1. Prekindle Will Collect & Remit Sales Tax on My Behalf

If this option is selected, Prekindle will automatically calculate, collect, and remit applicable sales tax for your events (currently available for qualifying Texas-based events).

2. Tax-Exempt Organizations

If your organization is tax exempt, you may submit a valid tax exemption form to the Prekindle Client Success team. Once approved, your account can be configured to not collect sales tax.

3. I Will Handle Sales Tax on My Own

If this option is selected, Prekindle will not collect or remit sales tax on your behalf.

This option is commonly used if:

Your venue or organization is located outside of Texas

You are using your own merchant account

You prefer to manage sales tax independently

When this setting is enabled, you are fully responsible for calculating, collecting, reporting, and remitting any applicable sales tax.

If you need to update your tax preferences, please contact clients@prekindle.com.

Tax Forms & 1099-K

Regardless of your tax preferences:

Prekindle does not issue 1099-K forms

Prekindle does not provide sales tax filing documents

If you handle sales tax on your own or are tax exempt, all tax reporting and compliance is the responsibility of the event organizer.

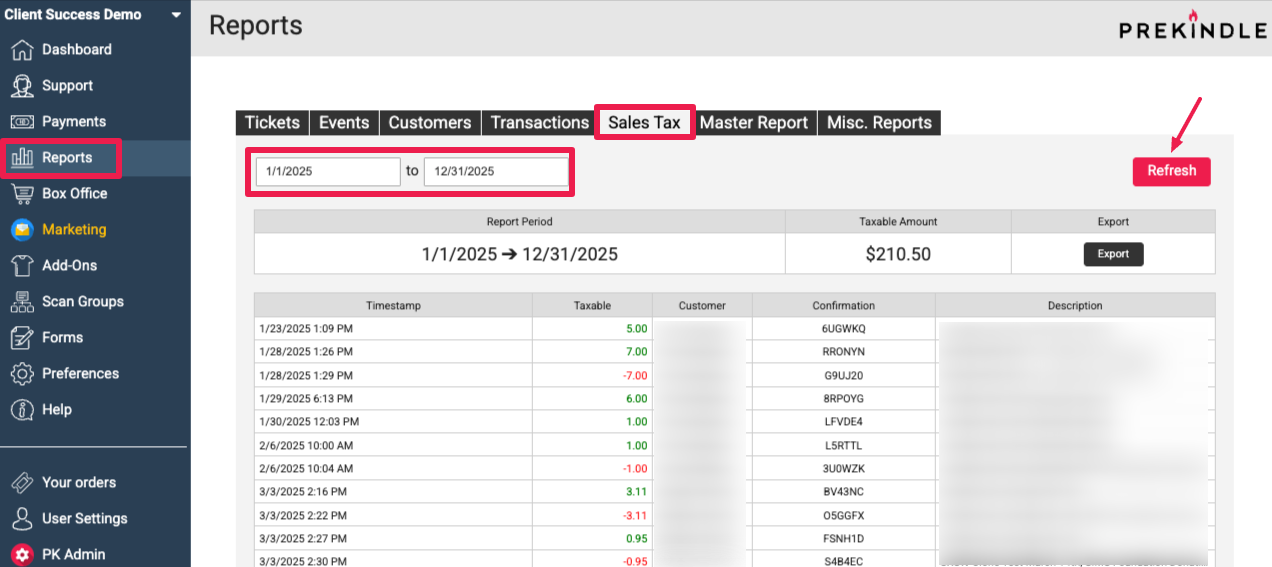

How to Find Your Taxable Sales Data

You can access your taxable transaction data directly in your Prekindle dashboard.

Click Reports in the left-hand navigation.

Select the Sales Tax tab.

Choose the date range you want to review.

Click Refresh.

Export the report for your records or tax filing.

This report can be used to determine your taxable sales totals when preparing your sales tax filings.

Important Note

Prekindle does not provide tax advice. We recommend consulting a tax professional or your local tax authority to ensure you are meeting all sales tax requirements for your jurisdiction.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article